Easy Online Legal Documents Customized by You. Ad Free Fill-in Legal Templates.

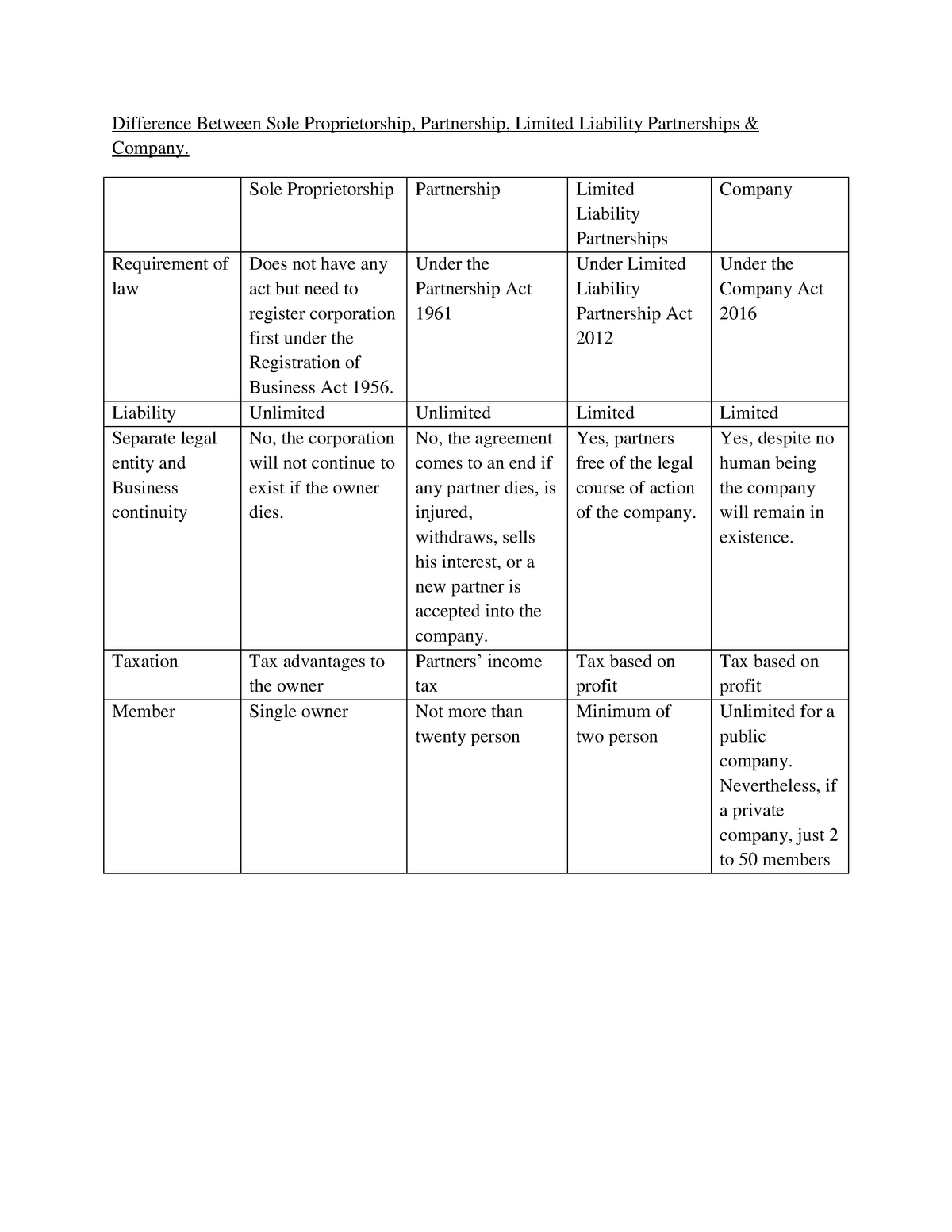

Difference Between Sole Proprietorship Partnership Joint Stock Com

A sole proprietorship is a.

. Very limited finances ADVERTISEMENTS. A sole proprietorship business is operated by one person. Popular business structures include corporations limited liability companies LLCs and S-corporations.

New business owners face a choice between starting a limited company or a sole traderpartnership depending on whether they have a partner or not. In a sole proprietorship if the owner dies or the business is. Also known as a DBA doing business as a sole proprietorship is the cheapest and.

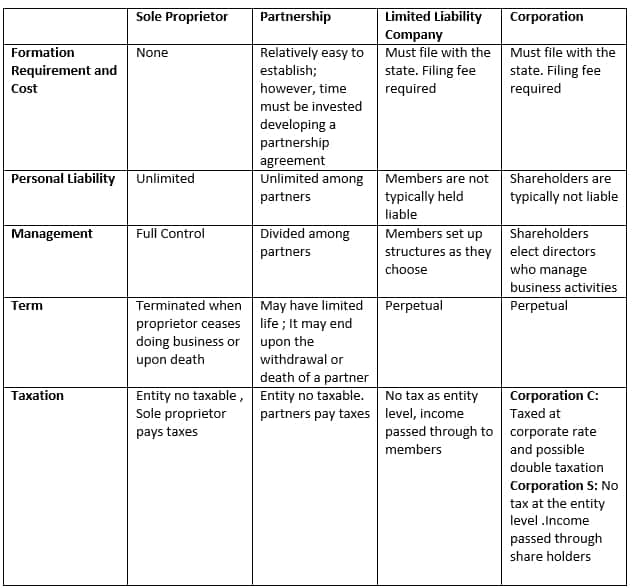

Start and Finish in Minutes. Conversely in Partnership there should be at least two partners and it can exceed up to 100. Combines a corporations liability protection and pass-through tax structure of a partnership.

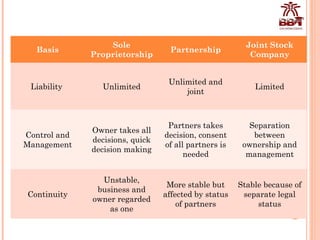

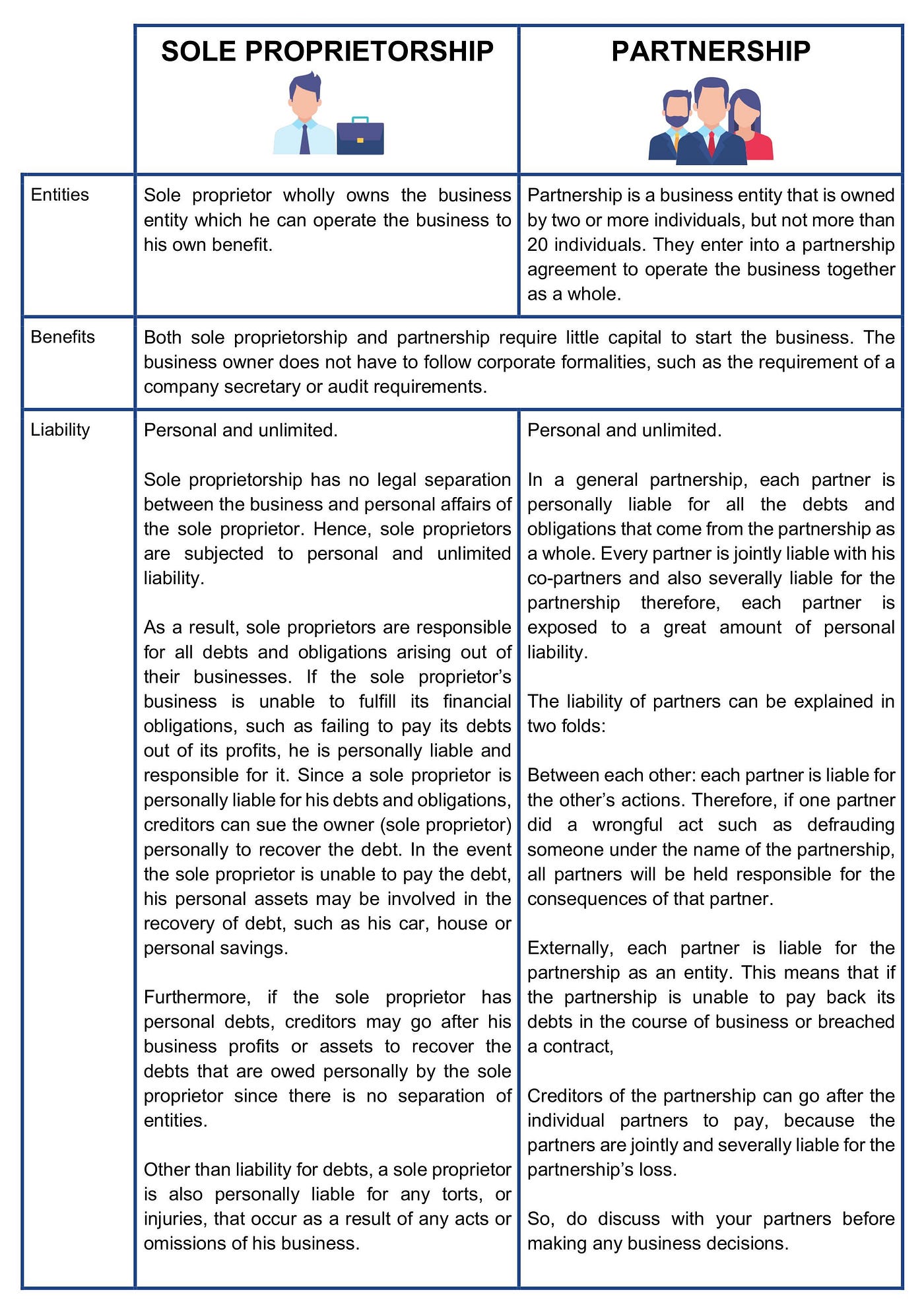

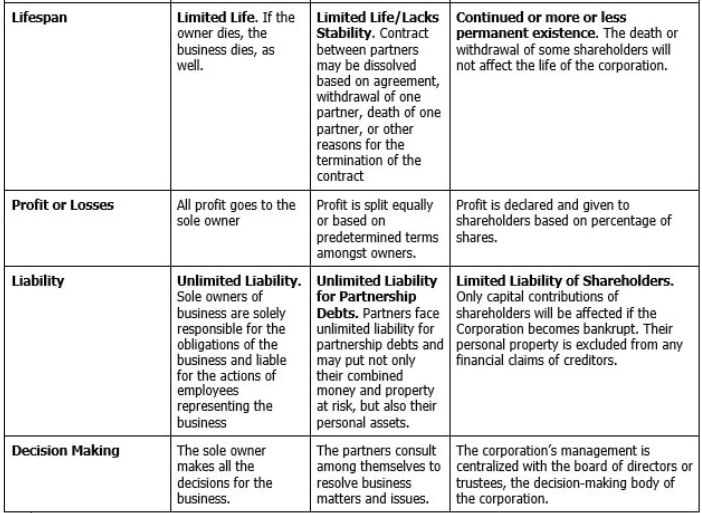

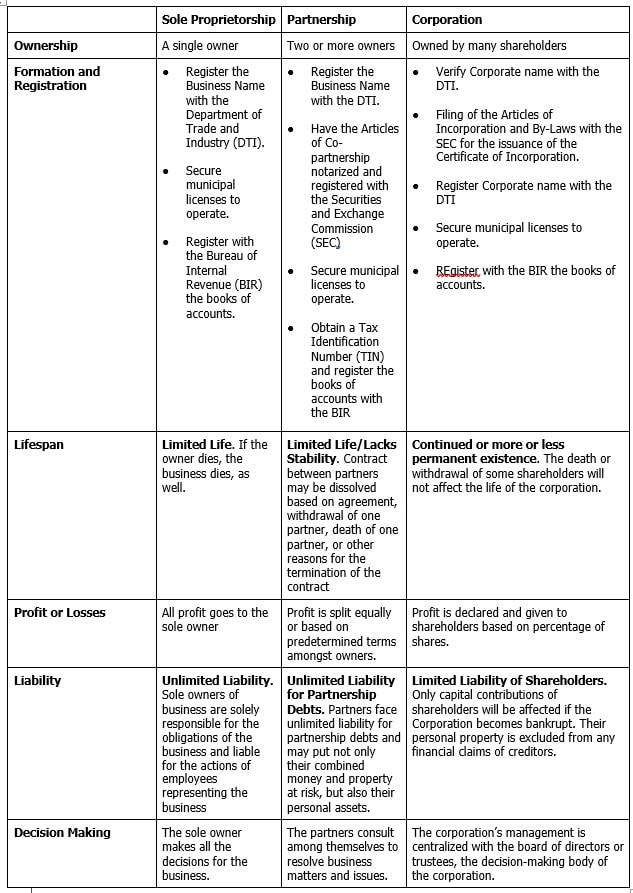

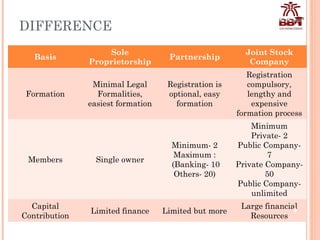

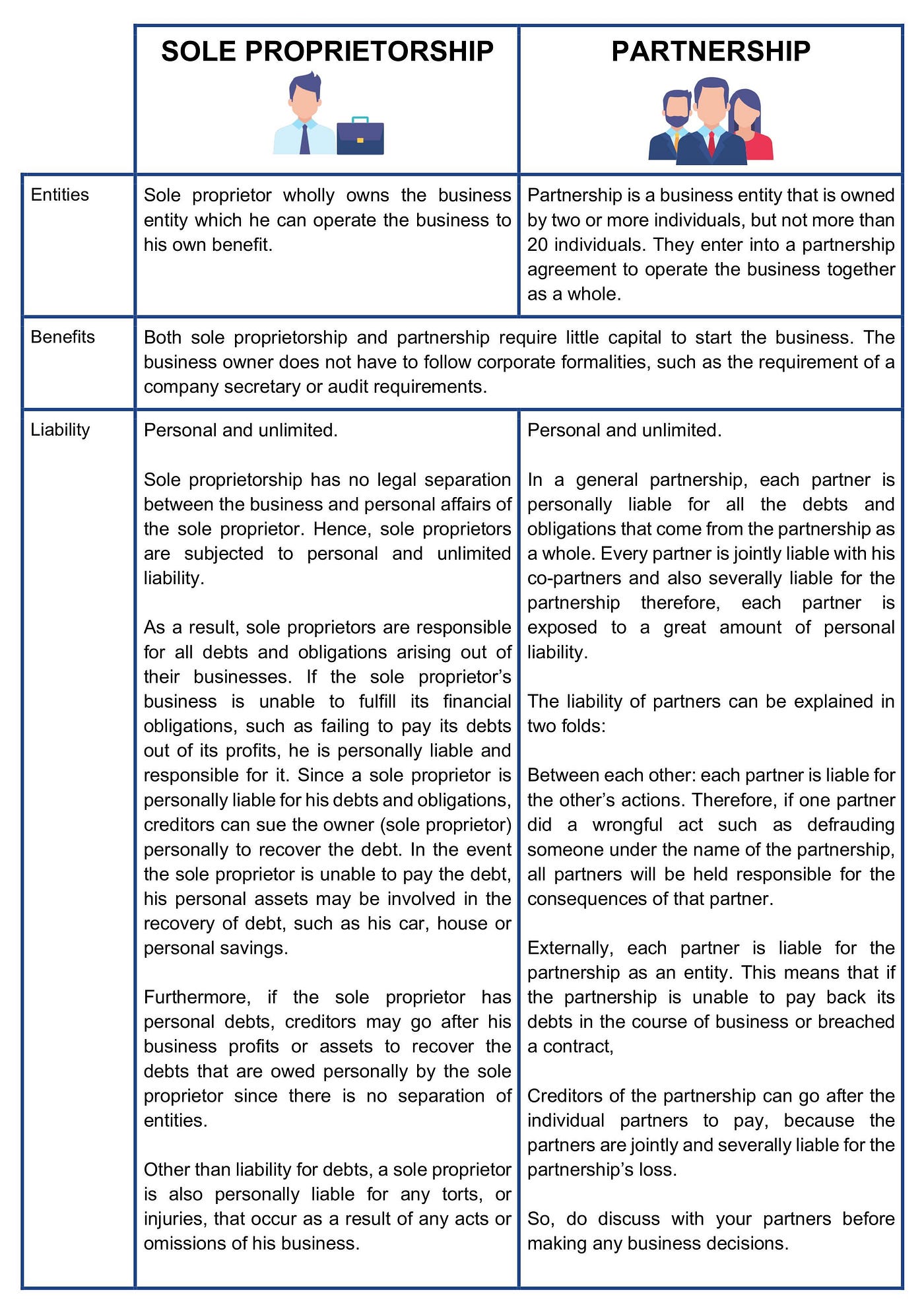

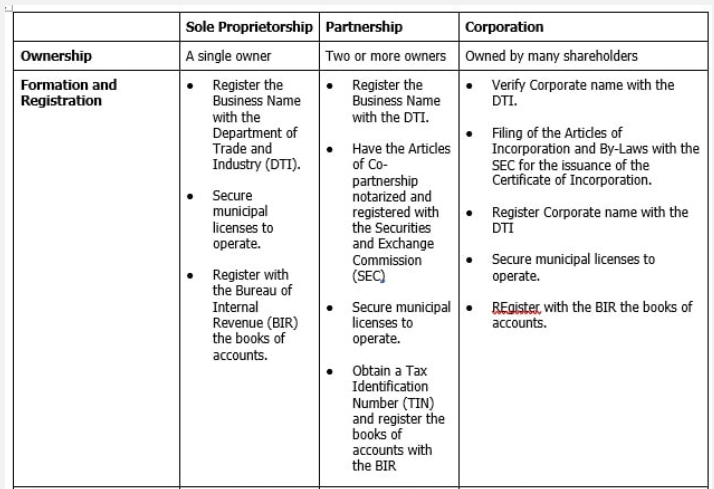

The following table will highlight the. The main difference between a sole proprietorship and partnership is the number of people who own and operate the business. A sole proprietorship has one owner while a partnership has two or more owners.

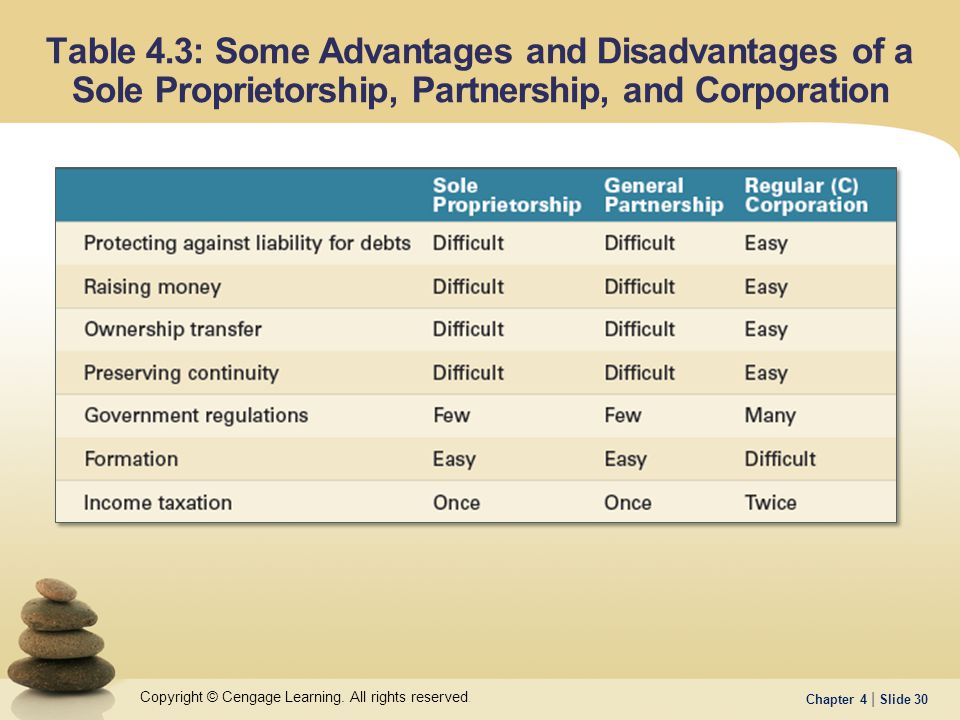

Companies have a complex structure due to their large number of people involved in. Compared to corporations and LLCs sole proprietorships and general partnerships are. Helping business owners for over 15 years.

The income is directly attributed to that person the Owner as business income. Difference among Sole-Proprietorship Partnership and Company. A partnership involves two or more individuals whereas a sole.

The members of the firm are bound by the Partnership Deed and no member can take a sole decision without consulting the other partners. Give us a call at 1-800-830-1055 to discuss your needs. Decision-making rests with the proprietor only hence full freedom to operate.

The basic premise of a Sole Proprietorship is a one-man owned controlled and directed entity with lesser regulatory burden and ease of operation. In that sense its more like a sole proprietorship. Sole proprietorships and partnerships are common business entities that are simple for owners to.

Subchapter S corporations and limited liability companies are other kinds of corporations. They are more complex than sole proprietorships and partnerships. For business owners looking to keep things simple however a sole.

Sole proprietorship partnership corporation or limited liability company LLC. The sole proprietor owns and manages the. Limited Liability Companies LLCs are a form of business.

In Sole Proprietorship the minimum and maximum limit of owners are one. A partnership also known as a general partnership is when two or more people operate a business that is not officially registered as an entity with the state. The main difference between sole proprietorship and corporation is that sole proprietorship is handled entirely by one individual.

A sole proprietorship is a form of business that is legally indistinguishable from the person running it. A sole proprietorship is an unincorporated entity that does not exist apart from its sole owner. A maximum of 20 partners unless it is a professional firm.

No maximum number unless it is a private company 50 members MANAGEMENT. Download Your Partnership Agreement Now. The business does not have a.

A partnership is different from a corporation because it is not separate from the individual owners. A limited company is. In a sole proprietorship only the owner of the business is liable for its debts and obligations.

Businesses are most commonly organized as sole proprietorships partnerships corporations and S corporations. There are three inherent differences between partnerships and sole proprietorships. Heshe is responsible for handling the.

Partnerships involve at least. IRS rules now allow LLCs to choose between being taxed as. The decision needs to be mutually acceptable to all partners.

A partnership is two or more people agreeing to operate a business for profit. Difference Sole Proprietorship. Because in both the business isnt.

One of the main differences between partnerships and companies is the formation structure. Here is a brief summary along with some of the advantages and disadvantages.

Forming A Partnership Lexology

Difference Between Sole Proprietorship And Llc Difference Between

Which Do You Think Is More Risky A Sole Proprietorship Or A Partnership Why Quora

Difference Between A Sole Proprietorship And A Partnership Tutor S Tips

Solved What Are The Advantages And Disadvantages Of Sole Proprietorships Course Hero

Chapter 4 Forms Of Business Ownership Introduction To Business

Learn About Proprietorship Chegg Com

Forming A Partnership Lawyers In The Philippines

Difference Between Sole Proprietorship Partnership Limited Liability Partnerships Company Studocu

What Are Some Features Of Sole Proprietorship Quora

Pdf Existence Of Sole Proprietorship In Business Activities In Indonesia Semantic Scholar

Chapter 4 Forms Of Business Ownership Introduction To Business

Difference Between Sole Proprietorship Partnership Joint Stock Com

Choosing A Form Of Business Ownership Ppt Download

Differences Between Sole Proprietorship And Partnerships

Want To Be Your Own Boss Here Is How By Legal Street Medium

Choosing The Right Legal Structure For Your Business Considerations For Start Up Businesses

Forming A Partnership Lexology

Difference Between Sole Proprietorship And Partnership And Joint Hindu Family Firm Brainly In